If you’ve started an OnlyFans, got verified, and began making fat stacks, you’re well on your way to the high life. However, there’s one more skill you’ll need to learn before hitting that gas pedal: how to file OnlyFans taxes.

Like any other topic concerning taxes and numbers, this one probably seems scary. But worry not, because our guide will teach you everything you need to know, including:

- Do OnlyFans creators pay taxes?

- What taxes do you need to pay?

- Which tax forms do you need?

- How to file taxes on OnlyFans

- Can you count on any tax write-offs as an OnlyFans creator?

- How often do you need to pay taxes for OnlyFans?

- Should you file the OnlyFans taxes on your own?

Keep reading to get all the info!

Do You Have to Pay Taxes on OnlyFans?

In the vast majority of cases, the answer to this question is yes.

Put simply, governments usually view content creators (adult or otherwise) as small business owners. So, you have to pay taxes for the money you make, as well as cover your own social and medical insurance.

As a result, the money you make on OnlyFans is taxable under income tax and self-employment tax. That includes everything from tips and subscriptions to income for pay-per-view content.

Now, just because you make some money on OnlyFans doesn’t mean that you must pay taxes. Every country has a certain threshold that your annual income has to cross to be taxable.

In the US, this threshold is $600 a year. The sum is quite small, as even beginners can earn more than that in just a few months, especially if they create in one of the popular niches on the platform.

So, if you want OnlyFans to be your main job and not just a hobby, you’ll definitely have to pay taxes for the gig to be legal. Speaking of main jobs and hobbies, the IRS actually treats these differently.

In practical terms, while both will be taxable, you may be able to deduct certain expenses from your business income. This will not be the case with hobby income.

If you’re having trouble determining where your income falls, here are some official pointers.

At the end of the day, though, the IRS will make the final decision on the matter after reviewing your case. Their decision will be based on a number of factors, including:

- Whether you are actively seeking to make a profit

- Your income, expenses, and profitability over the last 5 years

- Your history of money-making ventures

We will shed more light on tax deductions later.

What Taxes Do You Have to Pay as an OnlyFans Model?

As we already mentioned, your OnlyFans dough will be subject to two tax types:

- Income tax

- Self-employment tax

The former is pretty self-explanatory. You’ll pay taxes for your income — the more you make, the higher the tax.

Depending on the tax bracket you belong to, you’ll pay 10%, 12%, 22%, 24%, 32%, 35%, or 37% of everything you earn.

So, this tax treats your OnlyFans gig as any regular 9-to-5. The only difference is, you have no employer, at least on paper.

That is where the self-employment tax kicks in.

Namely, in the eyes of the law, you do not work for OnlyFans. Instead, you’re just an independent contractor using the platform to make money.

In other words, you are self-employed, which means you have to pay an additional tax.

If you’re in the US, this tax will consist of the social security tax (12.4%) and the medicare tax (2.9%). In total, you’ll have to pay 15.3% of your annual paycheck in addition to your regular income tax.

Naturally, these numbers vary from country to country. So, if you’re not in the US, check your local laws to find out the exact percentages.

With the basics out of the way, let’s tackle the forms you’ll need for your OnlyFans taxes.

What Tax Forms Do You Need for Filing OnlyFans Taxes?

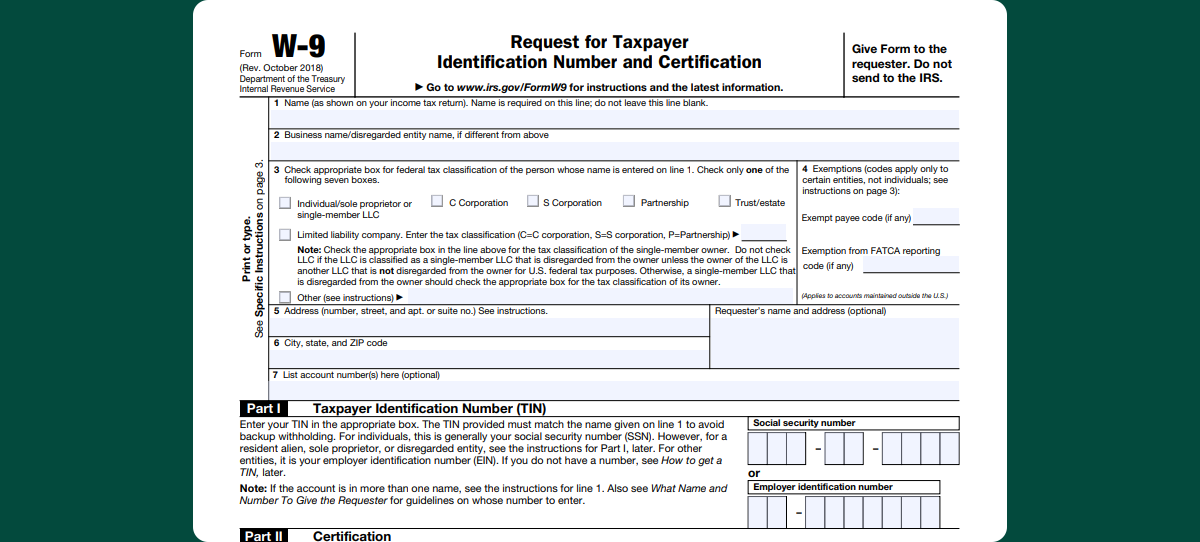

1. W-9 — Request for Taxpayer Identification Number and Certification

With regular 9-to-5 jobs, your employer takes out the tax percentage from your paycheck before sending it to you. So, the money you get is already taxed.

But with OnlyFans, things are a bit different. They just pay you everything you have earned (minus a 20% cut) without any tax deductions.

From then on, it’s up to you to file those taxes. Since OnlyFans has you fill out a W-9 form when withdrawing your money, the process is already set up in advance.

Namely, the form goes directly to the IRS and assures them that, while OnlyFans did pay you, you will be the one to finish the process.

Although the form looks intimidating, filling it out is actually quite easy. You’ll just need to provide the following:

- Full name

- Your full mailing address

- Your social security number

- Signature

Then, just check the box that shows you are an independent creator (Individual/sole proprietor or single-member LLC), and you’ll be all set.

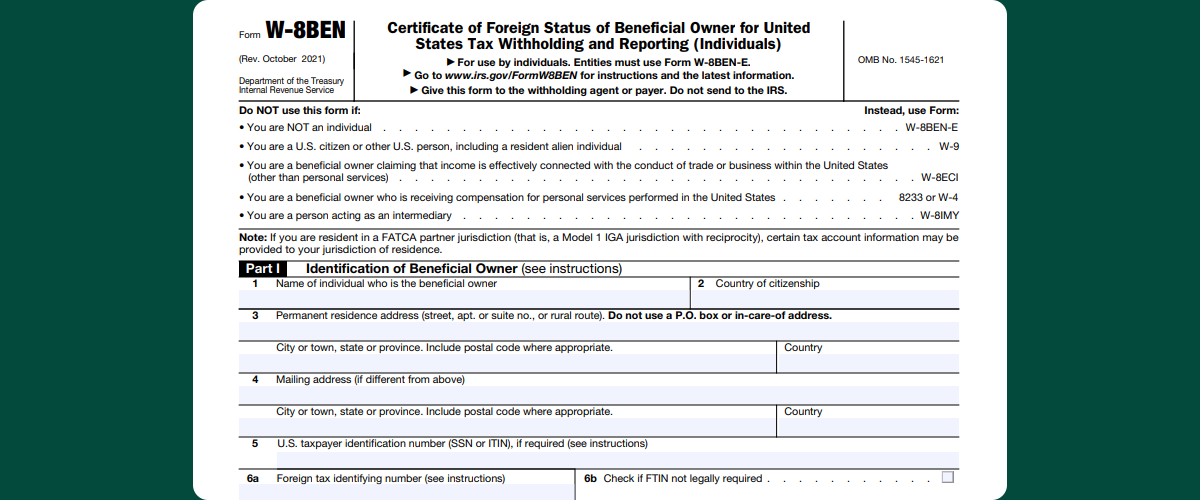

If you’re a non-US resident, though, you’ll need to fill out a W8-BEN form instead. It will just clarify to the IRS that you don’t live in the States and, therefore, don’t have to pay them taxes.

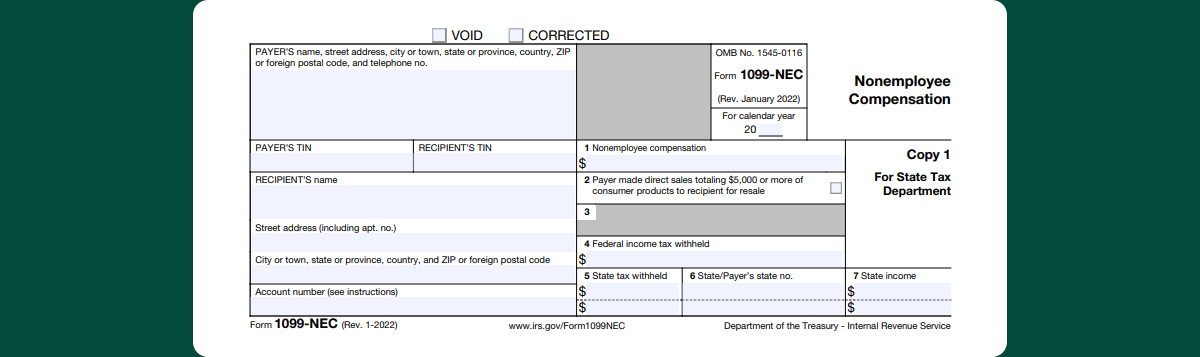

2. 1099 NEC — Nonemployee Compensation

Unlike the W-9, this form is not something you will have to fill out. Instead, it’s a document that OnlyFans potentially sends you once a year.

The 1099 NEC contains all the info about your annual gross business income as an OnlyFans creator. So, it’ll list every last penny you made from subs, tips, selling nudes, feet pics, sex tapes, or any other platform activities.

Now, you won’t get this form in your mail if you:

- Live outside the US

- Make less than $600 a year from OnlyFans

Otherwise, you can expect it in your mail by January 31st of every year. And if you’re impatient, you can also access it digitally under the Banking option in the main OnlyFans menu.

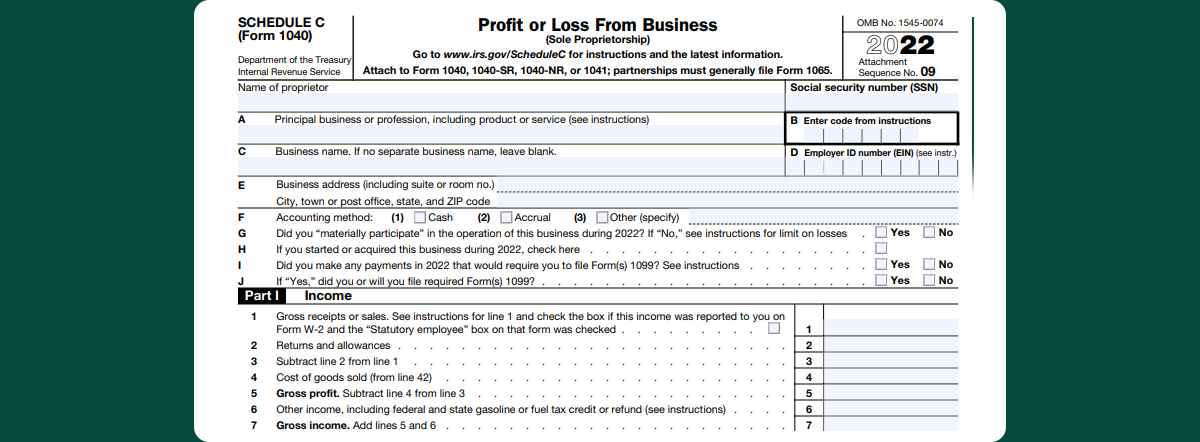

3. 1040 Schedule C — Profit or Loss from Business

Since your gig at OnlyFans counts as a small business in the eyes of the law, you will also have to file a 1040 Schedule C form.

Basically, this form lists all your earnings and expenses associated with OnlyFans. If you check it out, you’ll see exactly what we mean.

In it, you’ll be able to list everything you earned (the business income from your 1099 form) and spent in a year. When you deduct one from the other, you’ll get your net income — the taxable sum.

This is where the business income vs. hobby income part becomes important. Namely, if you’re classifying your OnlyFans income as hobby income, you’ll have to classify it as other income on the form.

The bit about expenses is just as important as the profits, so make sure to fill it out thoroughly and carefully. If you do, you’ll get a chance to receive some tax write-offs — more on that later on.

If you need help filling out the form, here’s a complete guide, explaining each item on the form.

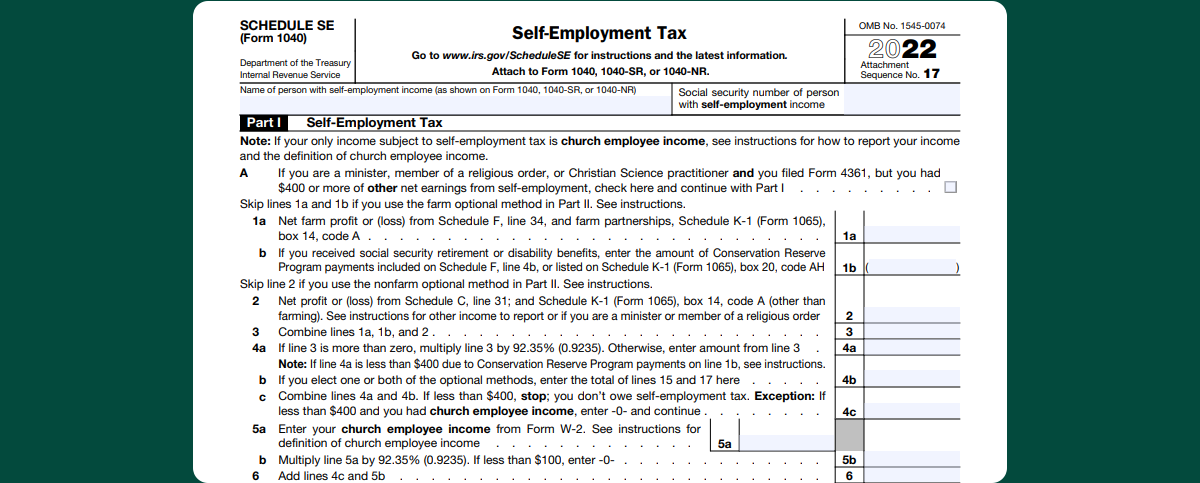

4. 1040 Schedule SE — Self-Employment Tax

And finally, the last piece of the puzzle: the self-employment tax form.

Now that you have your net income, you can calculate how much you have to pay for the social security and medicare taxes. As we stated earlier, the total should be 15.3% of the total sum.

Just write it in the form, follow the instructions you see on it in terms of calculations, and your OnlyFans tax return will be good to go.

In case you’re having trouble putting everything in place, we suggest taking a look at this helpful article that covers every item on the form.

Filing Your Taxes for OnlyFans

As complex as all these forms and documents probably seem, they’re really just foreplay. The real deal begins now, as you’ll have to actually file your tax return.

To do that, you have two options:

- Send the return by mail

- File it online

The first option is tried and true. You print out all your forms, seal them into envelopes, and send them to the IRS.

The only catch is, the agency could take up to 6 months to process your return and send your refund back.

That’s why it’s better to file everything online — on the official IRS website, 100% free. The process is easier than talking your boyfriend into a threesome, and it’s done just as quickly, too.

In the latter case, the refund waiting period is usually not longer than 3 weeks, which puts the 6-month wait to shame.

OnlyFans Taxes: Can You Get Any Write-Offs?

As you might already know, the law allows you to write off some of your business expenses. And the more things you can write off, the bigger your tax refund will be.

How does it all work for an OnlyFans creator? Let’s break it down.

Expenses You Can Write Off

You can potentially write off anything you bought for content creation within the year.

Examples include:

- Recording equipment (cameras, mics, props, sound equipment, computers, smartphones, etc.)

- Internet data (let’s say you spend around 40% of your internet data to run your OnlyFans — that’s how much of your internet bill you’ll be able to write off)

- Travel fees (going on a trip to shoot something for a high-paying client)

- OnlyFans’ platform and transaction fees

- Costumes, stage makeup, and potentially one-off hair styling (only if used specifically for shoots — if you use it in everyday life, it’s not deductible)

- Rent (if you rent out a space for creating your content)

- Commissions and wages (if you work with a team)

… and a bunch of other stuff — hopefully you get the drift. As long as an expense directly helped you run and expand your business, it’s possible to write it off.

However, keep in mind that the IRS may request proof that a write-off was indeed a business expense.

That is why we heavily suggest that you keep all physical items and purchase records on hand in case you need them.

Expenses You Can’t Write Off

On the other hand, you can’t write off anything you will benefit from in everyday life, even if it indirectly aids your content creation.

For instance, cosmetic surgery might make you look sexier, but it will also affect your daily life, making it non-deductible.

Non-deductible expenses include, but are not limited to:

- Cosmetic services (tanning, hair removal, haircuts and styling, facials, nail care, etc.)

- Beauty products (makeup, skincare products, supplements, etc.)

- Clothing (if you can wear it outside without raising eyebrows, it’s not deductible)

- Health and fitness services (personal trainers, gym memberships, and the like)

- Medical expenses and body modification (teeth straightening or whitening, tattoos, piercings, breast implants, lip fillers, and other cosmetic surgery)

The IRS has a pretty comprehensive guide on what you can and cannot deduct, so definitely check that out here.

How to File OnlyFans Tax Write-Offs

As we already mentioned above, you should include these write-offs in your Schedule C form. You have plenty of room (more than 30 rows, to be exact), so you can rest assured that you’ll be able to add everything.

Again, make sure that you have evidence to back up each expense you want to write off. That includes all Onlyfans-related receipts and bills that prove you bought an item.

It doesn’t happen too often, but the IRS could contest your form and ask for hard evidence of your purchases. So, it’s important to always have it ready until the return is cleared.

When Do You Have to Pay Your OnlyFans Taxes?

In the United States, paying taxes is a quarterly task for everyone who owes more than $1,000 a year. That includes most small businesses, from porn company owners to OnlyFans creators.

Long story short, you’ll have to file a single annual report but pay four times per year.

Of course, you can also settle it all at once. But if you do that, you will have to pay an interest fee, as well as certain additional penalties.

Therefore, as annoying as it is, it’s better to pay every quarter. Besides helping you avoid interest, it’ll also be easier on your budget.

After all, paying in 4 smaller installments is a lot more manageable than shelling it out all at once — especially at the end of a calendar year.

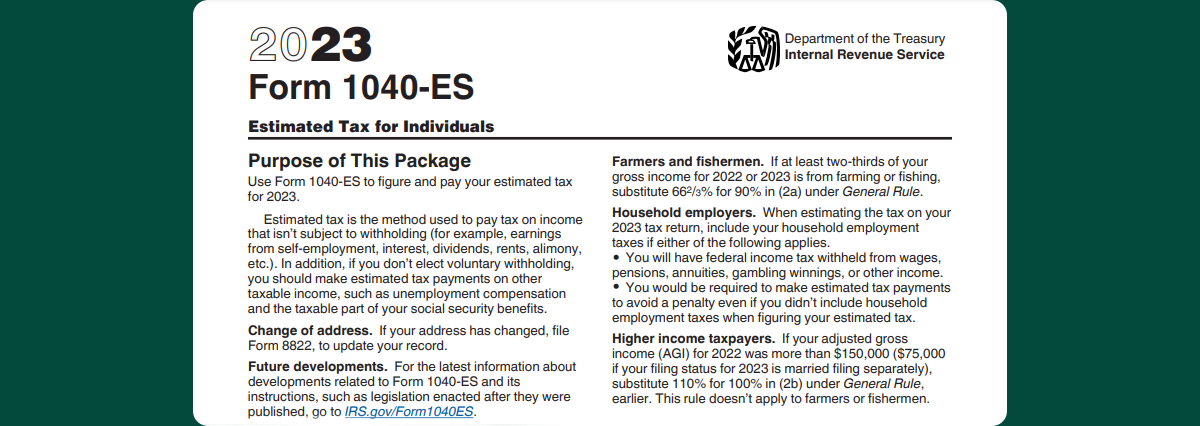

Now, you’re probably wondering, How can I pay taxes when I’m only filing my return at the end of the year? Well, it’s simple: you have to estimate the numbers.

In short, you’ll need to guess how much you’ll owe in taxes and pay it. You can calculate this sum by taking a look at your last tax return for a certain quarter and the instructions in this form.

As scary as this sounds, the IRS gives you a 10% margin of error with these estimates. So, you won’t get in trouble if your numbers are slightly off.

Once you’ve got your estimate, you simply mail a check to the IRS for every quarter or pay online. Again, the latter is a lot quicker, and the agency will process everything within a month.

The exact payment deadlines for every quarter are always the same:

- April 15th

- June 15th

- September 15th

- January 15th (of next year)

Therefore, it’s up to you to make sure that you mail the check or make an online payment before each of these dates, every year. Have that covered, and you’ll be sailin’ smooth like with Astroglide.

Should You File Your OnlyFans Taxes All Alone?

Filing and estimating taxes — whether for your OnlyFans adventures or a regular day job — can be a big nuisance. It’s especially tricky if you aren’t big on numbers (except when it comes to the figures on your bank account).

In that case, it’s a good idea to use tax paying software. QuickBooks is a reliable option, as are TurboTax and TaxAct.

These platforms can help you with calculations, estimates, getting your info right, and filling out forms. So, they’re a great resource to fall back on.

These platforms can help you with calculations, estimates, getting your info right, and filling out forms. So, they’re a great resource to fall back on.

And if you’d like to take things a step further, you can also hire an accountant or tax preparer to do everything for you. These are certainly worthwhile if you’re making big bucks and having trouble keeping up with everything.

That way, you’ll be able to focus on making more content (and money) and leave the number crunching to someone else.

Conclusion

It may seem tricky, but filing and paying OnlyFans taxes is pretty easy with the right info and help. Now that you have all the deets, get to work — that annual report won’t file itself!